October 2024 Monthly Market Insights

Data and opinions as of September 30, 2024

Rate cuts and stimulus bolster markets to new highs

In September 2024, financial markets responded positively to the U.S. Federal Reserve's (Fed) unexpected 50 basis point rate cut and China's ambitious stimulus package aimed at revitalizing its economy. The Fed's decision signals a proactive approach to support growth amid easing inflation, potentially also boosting U.S. equities in the coming months. Meanwhile, China's measures to lower reserve requirements and interest rates on mortgages are intended to stimulate consumer spending, creating a more favourable outlook for global markets despite ongoing inflation concerns.

The NEI perspective

The Fed surprised markets with a significant 50 basis point rate cut, citing concerns about weakness in the labour market. This decisive action signals confidence in inflation, which has eased to around 2.5%, to continue to moderate. Bottom line: Easing monetary policy, moderate economic growth, along with strong corporate earnings growth creates a positive environment for equities. Therefore, diversification and a high-quality focus are key.

Inflation continues to ease across the U.S., Canada and Europe, allowing for rate cuts and creating a favourable environment for equities. A recent update in the 2026 consensus estimates for corporate earnings also points to strong growth rates. Bottomline: We’re moderately bullish on equities as economic growth continues.

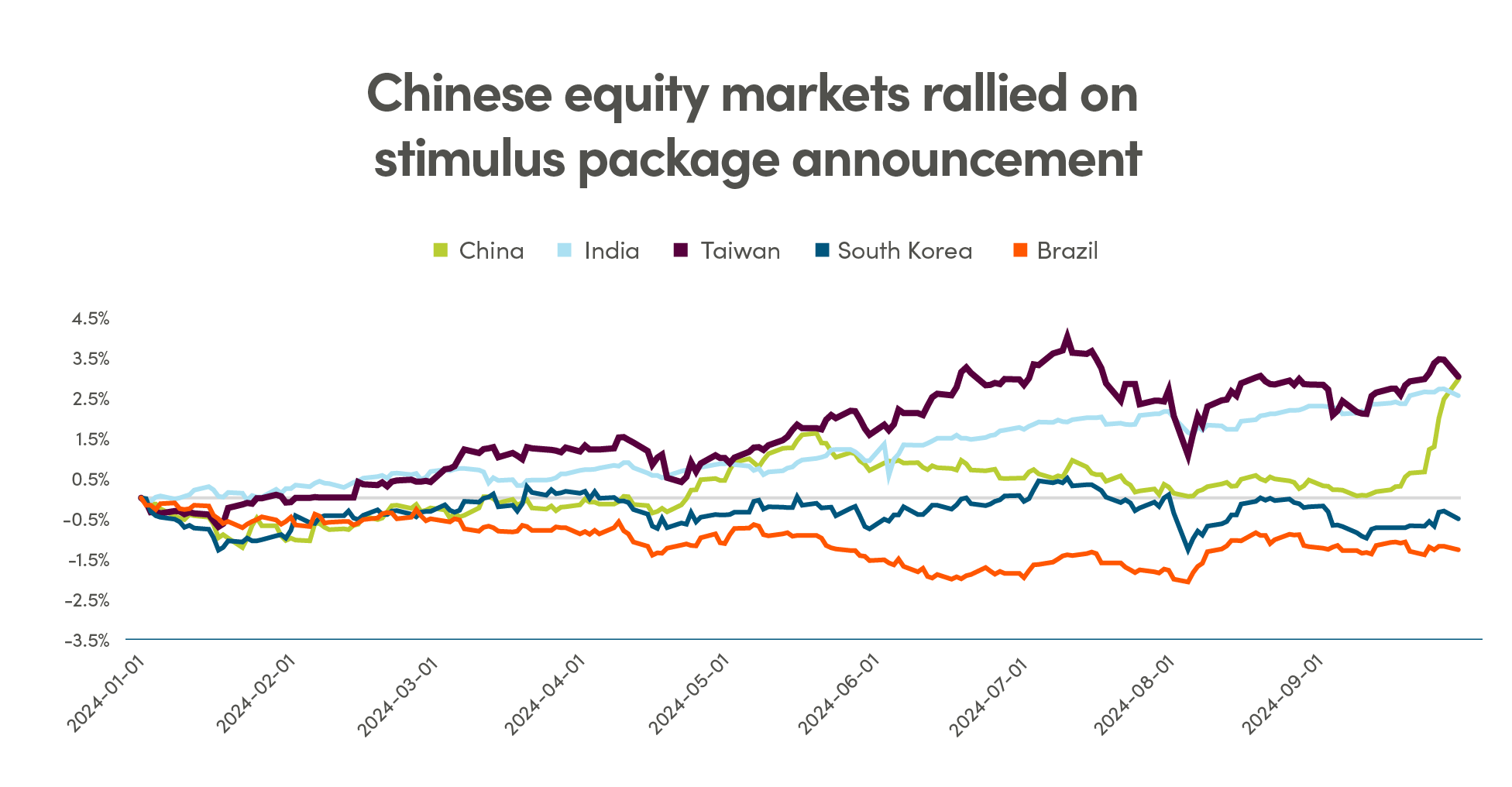

China announced a stimulus plan in a rare September meeting to address economic challenges, emphasizing the need for effective policies, increased fiscal spending, and aggressive interest rate cuts to achieve a 5% growth target. A proposed stimulus package worth at least 2 trillion yuan aims to stabilize the property market and support low-income groups.

Bottom line: These measures signal a proactive approach to economic growth, however the effectiveness of these measures to stem the weakness in consumer confidence remains uncertain.

‒ NEI Asset Allocation team

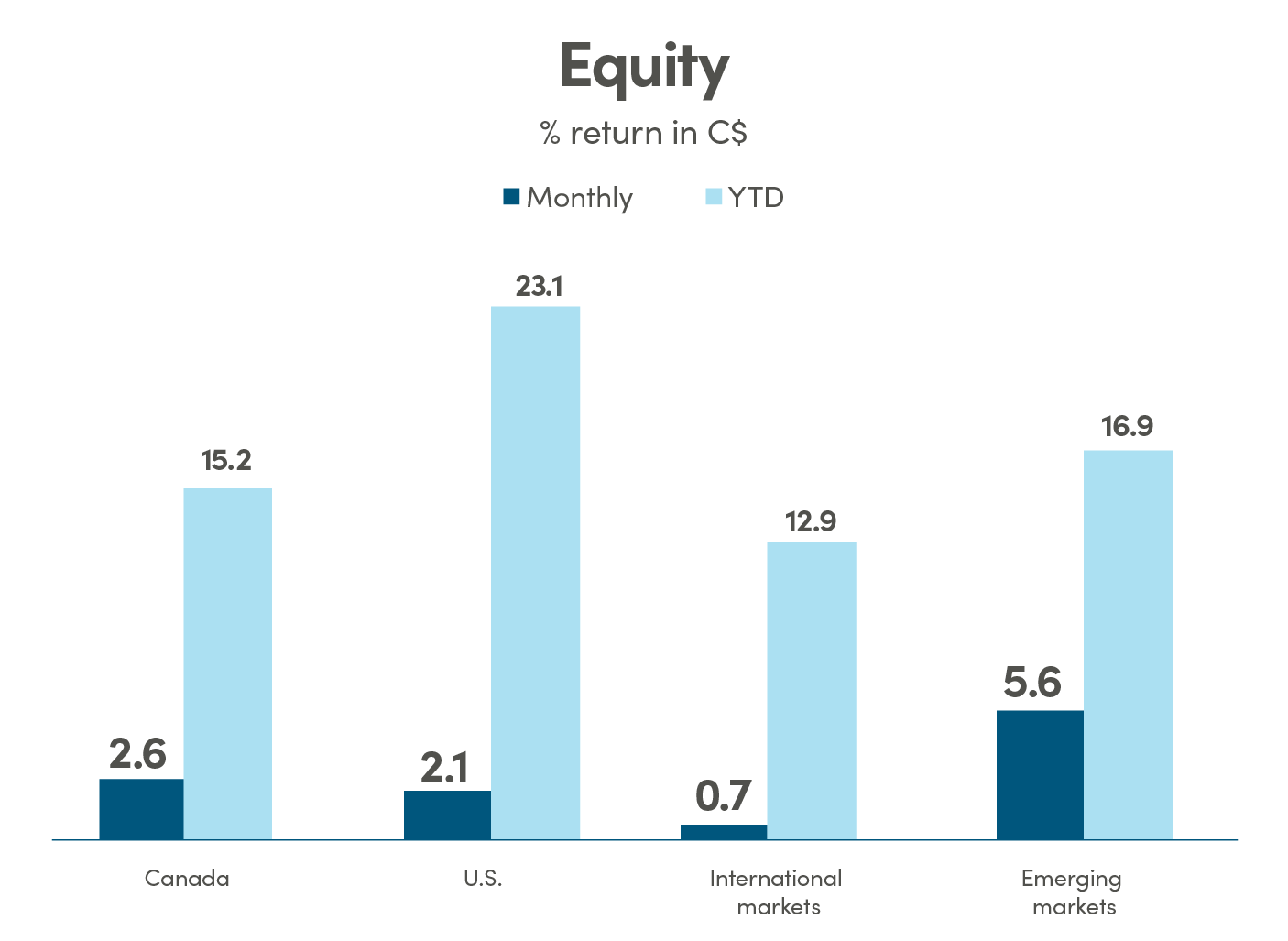

Canada: MSCI Canada; U.S.: MSCI USA; International: MSCI EAFE; Emerging markets: MSCI Emerging Markets. Source: Morningstar Direct

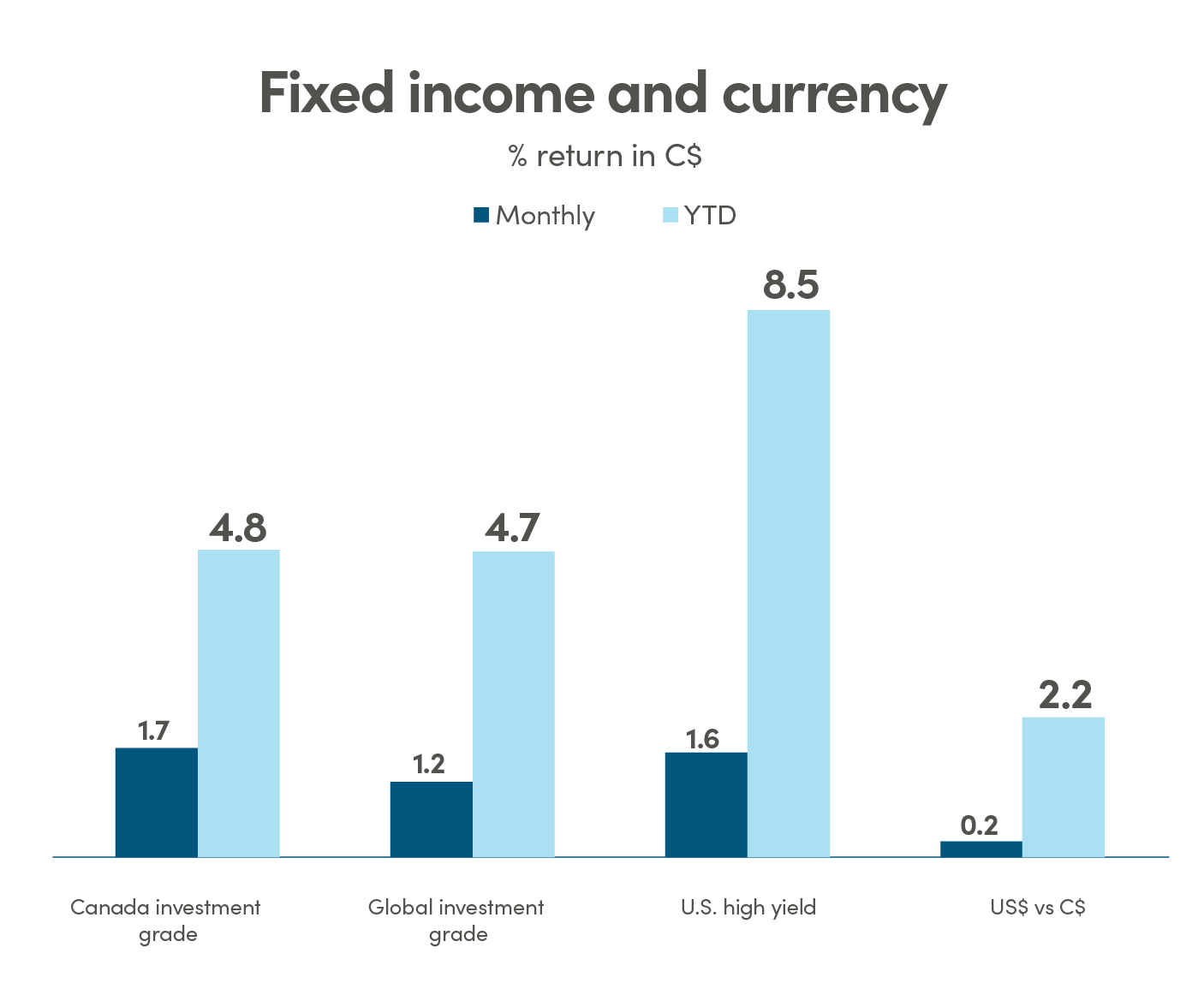

Canada investment grade: Bloomberg Barclays Canada Aggregate; Global investment grade: Bloomberg Barclays Global Aggregate; U.S. high yield: Bloomberg Barclays U.S. High Yield. Source: Morningstar Direct

The Fed’s double rate cut on moderating inflation

In a somewhat surprising move, the Fed announced a significant rate cut of 50 basis points during its September meeting, marking the first reduction in over four years. This "double" cut was unexpected, as many analysts had anticipated a more conservative 25 basis point decrease. The decision reflects the Fed's response to easing inflation rates and a desire to support economic stability amid signs of a slowing labour market. Fed Chair Jerome Powell emphasized that the Fed is not declaring victory over inflation but is adjusting the policy to ensure continued economic growth and employment stability.

September 2024 has brought encouraging data on inflation across the U.S., Canada and Europe, with the Consumer Price Index (CPI) showing signs of stabilization. In the U.S., CPI has decreased to around 2.5% yearover-year, down from previous highs, suggesting that inflationary pressures are easing. This trend is echoed in Canada, where the Bank of Canada cut interest rates to support economic growth, and in Europe, where the European Central Bank also lowered rates amid slowing inflation. In contrast, UK’s inflation remained stubbornly high, and Bank of England opted to keep rates unchanged as a result.

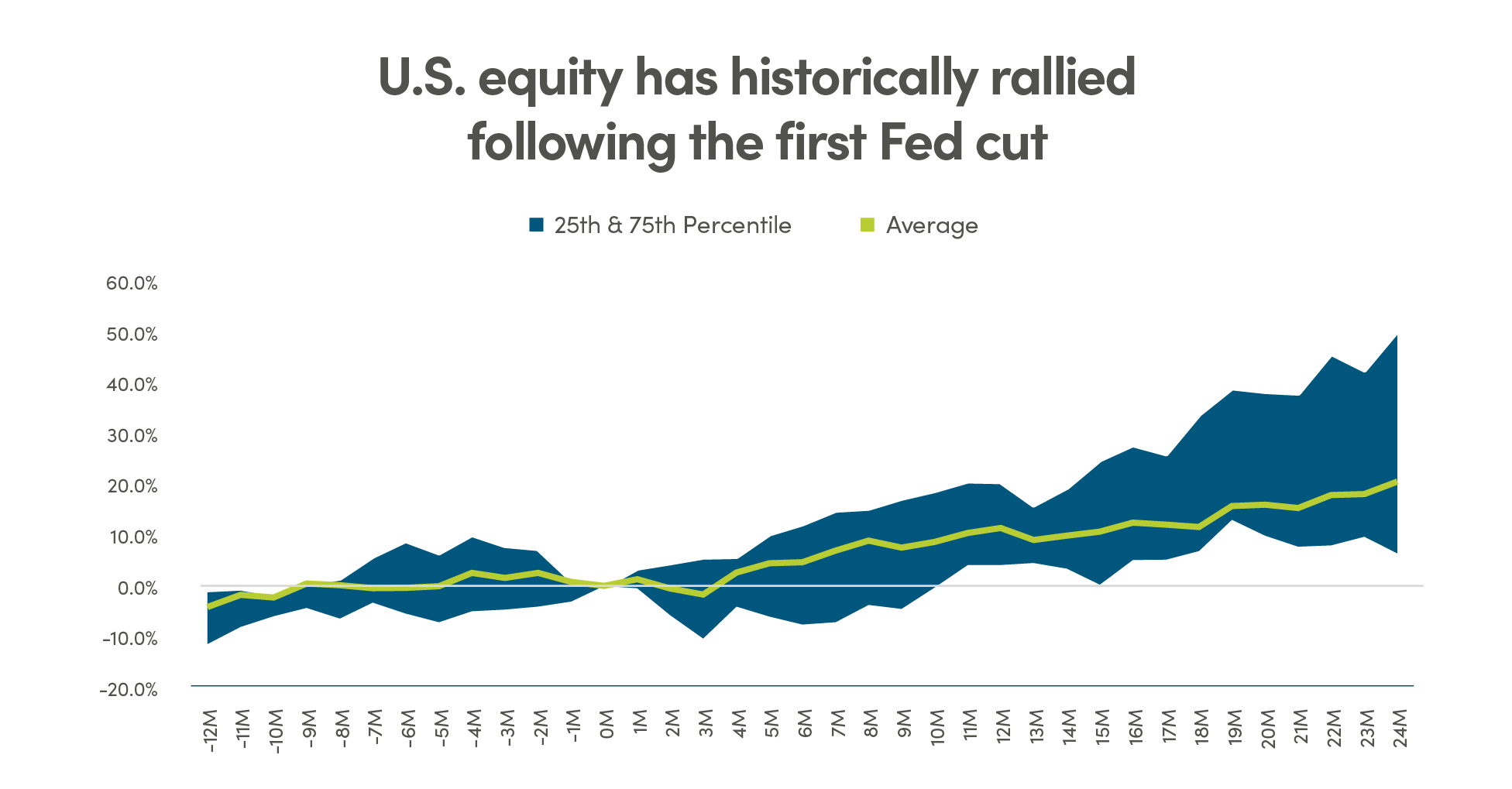

Source: Bloomberg

Lower interest rates typically enhance borrowing affordability for consumers and businesses, potentially stimulating spending on major purchases like homes and vehicles. Historically, equity markets have on average had positive returns following the start of the easing cycle, as investors expect that the combination of increased spending and reduced borrowing costs will support corporate earnings and equity prices.

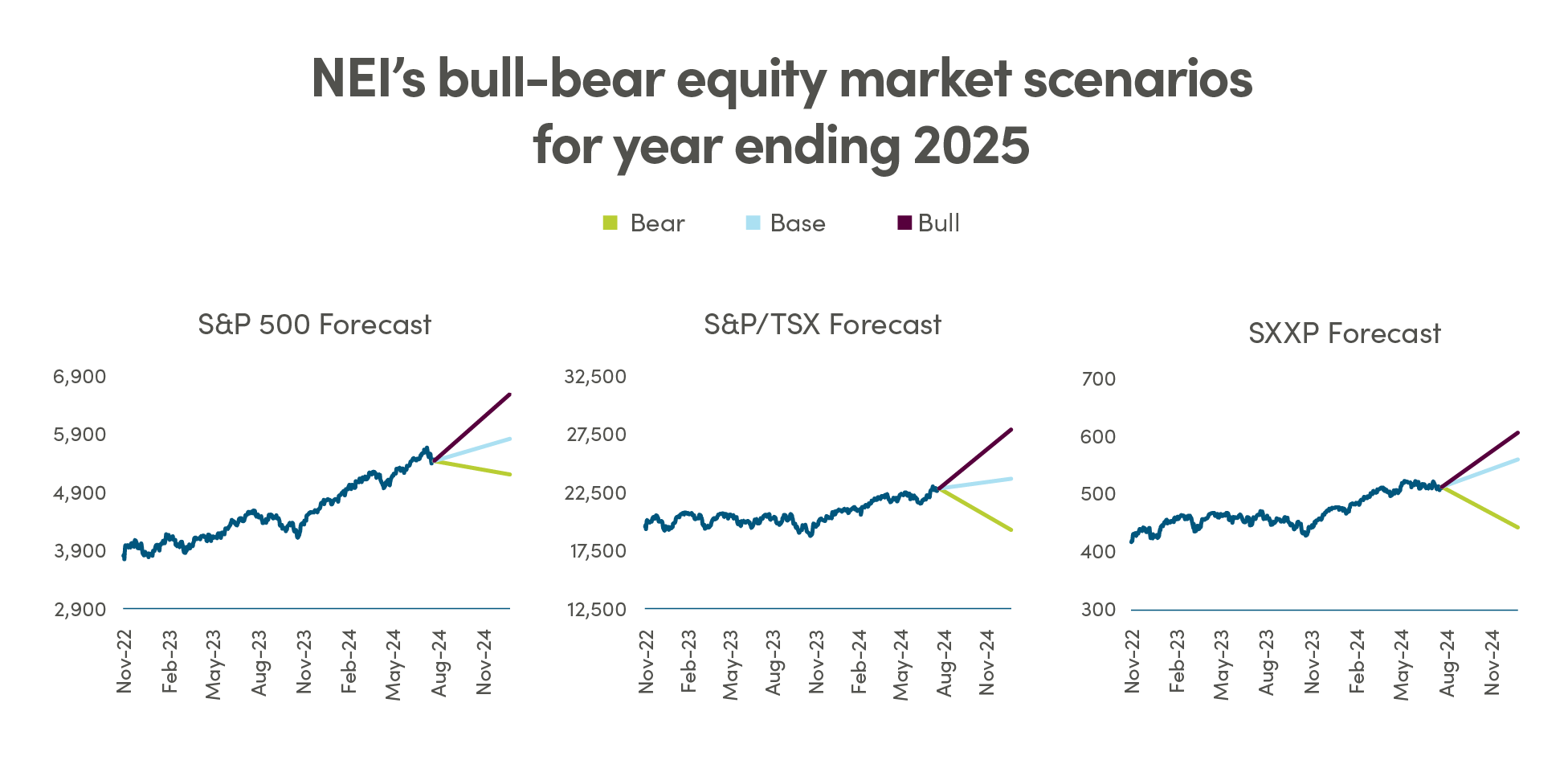

Focus on shift to 2026 earnings

As we move into October, the market shifts its focus to companies’ forward earnings prospects as the key valuation mechanism. The key driver for market movements transitions from corporate earnings growth in 2025 to corporate earnings growth in 2026. Unlike most years, the most recent forward earnings estimates for 2026 have been continuously revised upwards, with S&P 500 earnings now estimated to grow by 10% in 2026, and Europe 600 Index at 8%, contributing to a more bullish outlook for equities in 2025. The TSX Index is estimated to grow by 3% in 2026, a much slower pace than the 13% estimate for 2025.

Source: Bloomberg

Bottomline: As the ease cycle continues, equity markets tend to perform well absent of a recession. Recession probability remains low across the U.S. and Canada, resulting in a favourable environment for equities. We remain optimistic about the dynamics supporting equity markets — moderating inflation, declining interest rates, robust corporate earnings, and improving consumer sentiment — however it's essential to balance this outlook with caution. Should inflation resurge, the pace of rate cuts may slow, which could dampen market enthusiasm. The path of easing may fall out of sync with market expectations from time to time, which is a source of volatility. Some sources of downside risk and additional volatility include the upcoming U.S. presidential election, the potential resurgence of inflation, and wider escalation of conflict in the Middle East. Overall, while we remain moderately bullish on equity markets, we stay diligently focused on maintaining a diversified and a high-quality portfolio.

Chinese unleashed bold stimulus to support ailing economy

China's Politburo held a rare September meeting to discuss the economy, signaling heightened urgency to support growth. The meeting stressed the need for more effective policies, increased fiscal spending, and aggressive interest rate cuts to meet this year's growth target of around 5%. The People’s Bank of China cut interest rates to help stabilize struggling property owners, eased borrowing restrictions in order to support the capital markets, and lowered reserve requirements to support bank lending and improve liquidity in the markets. The Politburo's proactive stance suggests a significant course correction from an earlier crackdown on excessive borrowing from developers. The fiscal stimulus package is estimated to be worth at least 2 trillion yuan, including support for consumption, local government debt relief, and bank recapitalization. This stimulus, combined with lower mortgage rates, could boost GDP growth by over one percentage point. However, more support may be needed to address deep-seated structural issues, such as a deflationary trend in the economy, the overbuilt and excessively leveraged property sector, high unemployment amongst young people, and low consumer demand.

Source: Bloomberg

Legal

Aviso Wealth Inc. (“Aviso Wealth”) is the parent company of Credential Qtrade Securities Inc. (“CQSI”), Credential Asset Management (“CAM”), Qtrade Asset Management (“QAM”) and Northwest & Ethical Investments L.P. (“NEI”). NEI Investments is a registered trademark of NEI. Any use by CQSI, CAM, QAM or NEI of an Aviso Wealth trade name or trademark is made with the consent and/or license of Aviso Wealth. Aviso Wealth is a wholly-owned subsidiary of Aviso Wealth Limited Partnership, which in turn is owned 50% by Desjardins Financial Holdings Inc. and 50% by a limited partnership owned by the five Provincial Credit Union Centrals and the CUMIS Group Limited.

This material is for informational and educational purposes and it is not intended to provide specific advice including, without limitation, investment, financial, tax or similar matters. This document is published by CQSI, CAM and QAM and unless indicated otherwise, all views expressed in this document are those of CQSI, CAM and QAM. The views expressed herein are subject to change without notice as markets change over time. Views expressed regarding a particular industry or market sector should not be considered an indication of trading intent of any funds managed by NEI Investments. Forward-looking statements are not guaranteed of future performance and risks and uncertainties often cause actual results to differ materially from forward-looking information or expectations. Do not place undue reliance on forward-looking information. Mutual funds are offered through Credential Asset Management Inc. Mutual funds and other securities are offered through Credential Qtrade Securities Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise stated, mutual fund securities and cash balances are not insured nor guaranteed, their values change frequently and past performance may not be repeated.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. The MSSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to computing, computing or creating any MCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages.